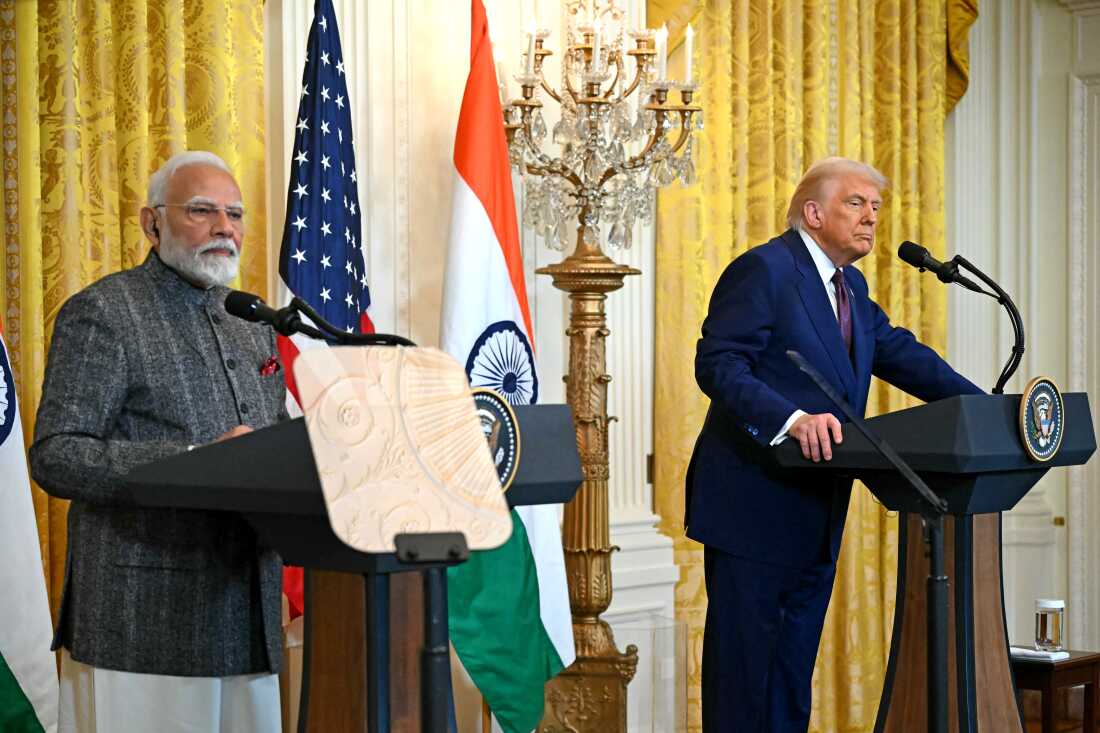

Trump Warns India: Higher Tariffs Coming Over Russian Oil

US President Donald Trump has ramped up warnings to India, threatening even higher tariffs unless New Delhi further curbs purchases of Russian oil. In comments aboard Air Force One on January 4, 2026, Trump said PM Narendra Modi is “not that happy with me” due to existing duties, but noted India’s recent reductions in imports as an effort to “make me happy.”

Trump praised Modi as a “very good man” while insisting the US could raise tariffs “very quickly” if cooperation falls short. This ties directly to the ongoing Russia-Ukraine conflict, where Washington accuses discounted Russian crude of funding Moscow’s war efforts.

The pressure builds on August 2025’s escalation: The US imposed an additional 25% penalty on Indian goods (totaling 50% on many items) specifically linked to Russian oil buys. Sectors like textiles, IT, and pharma felt the hit, with trade talks stalling amid mutual accusations.

India’s Import Reduction & Refiner Moves

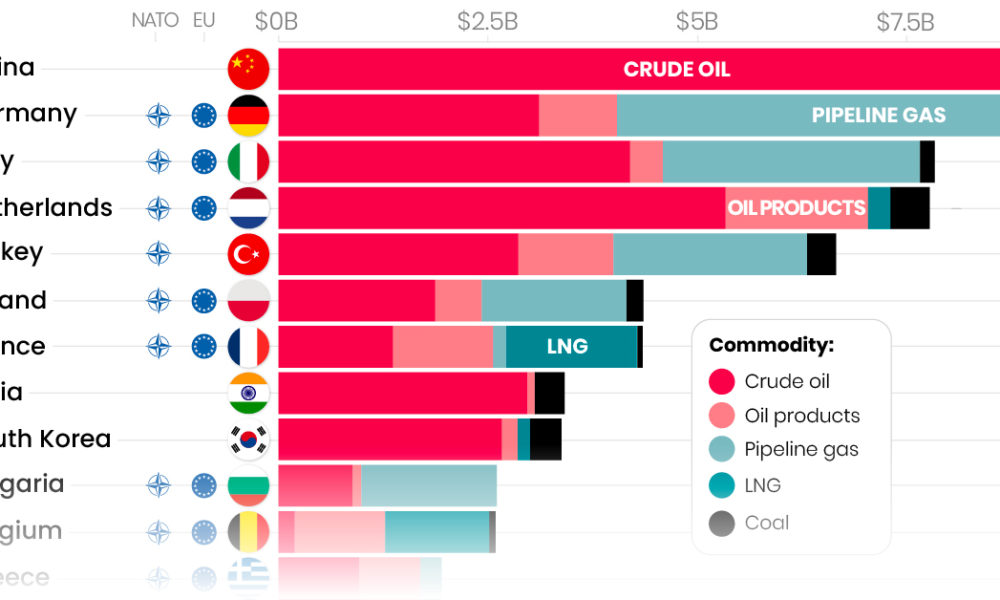

India has significantly cut Russian oil imports in response. From peaks of 1.8 million barrels per day (bpd) post-2022 Ukraine invasion, volumes dropped to around 1.24 million bpd in December 2025 (a 38% fall from November peaks), per Kpler data—the lowest since late 2022.

Reliance Industries (India’s top buyer) confirmed no Russian deliveries in January 2026 and expects none soon. State refiners like IOC and BPCL continue some purchases but disclose weekly data to the government amid US deal hopes.

Despite cuts, Trump and allies like Senator Lindsey Graham argue it’s insufficient. Graham claimed India’s US Ambassador sought relief after showing reduced buys, crediting tariffs for the shift.

The bipartisan Sanctioning Russia Act 2025 (85+ Senate co-sponsors) gives Trump authority for up to 500% tariffs on nations engaging in Russian petroleum/uranium trade—potentially targeting India, China, and Brazil if no peace progress in Ukraine.

Economic Impact & Market Reactions

Nifty IT fell ~2.5% on the warnings, with oil/gas stocks down 2.8% in recent sessions. Reliance shares dipped amid uncertainty.

India maintains energy security as priority, rejecting external dictates. Diversification to US, Middle East, and others continues, but analysts warn prolonged tariffs could raise costs for consumers and exporters.

(Responsive / Native Ad)

New US Ambassador Sergio Gor arrives January 12, prioritizing zero Russian imports. Trade deal revival hangs in balance—six rounds held, but farm market access and other issues remain sticking points.

Social Media & Expert Buzz

#TrumpTariffs and #IndiaRussiaOil trend with mixed reactions—some see bullying, others pragmatism.

Real-time takes:

Trump’s Air Force One warning to India over Russian oil has the Nifty IT index sliding 2.5% means the "Strategic Grey Zone" is officially closed DYOR

— DavidB5ive (@EFrancis48305) January 11, 2026

New tension in global trade A proposed 500% tariff on India over Russian oil purchases is shaking international markets. How big will the impact be on South Asia and the global economy? 🤔

— Computer Mania BD (@ComputerManiaBD) January 11, 2026

Experts note even full stoppage may not end pressure—trade could pivot to other disputes. India eyes EU/others for balance, pushing self-reliance in energy/defense.

This US-India dynamic tests diplomacy amid global shifts. HotBuzz tracks every twist—bookmark for updates!

Hot

Hot